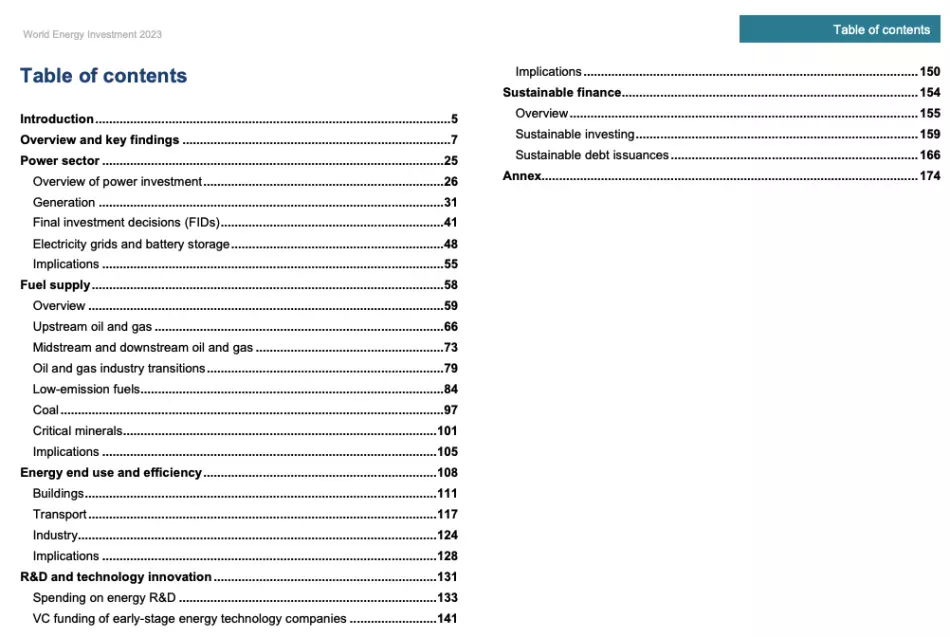

The World Energy Investment 2023 report provides an analysis of capital flows in the energy sector globally. The report highlights the impact of the global energy crisis and changing climate on energy investments and security. The report also examines policies and incentives that support clean energy spending and investments aligned with solutions to the climate crisis. The report is structured into six chapters covering the overview and key findings, the power sector, fuel supply investment, energy efficiency and end-use sectors, energy research and development, and energy finance.

The report benchmarks current trends against future scenarios presented in the IEA World Energy Outlook. The Stated Policies Scenario (STEPS) considers aspirational targets only if backed by detailed policies, while the Announced Pledges Scenario (APS) assumes all climate commitments and net zero targets will be met in full and on time. The Net Zero Emissions by 2050 Scenario (NZE Scenario) presents a narrow but achievable pathway for the global energy sector to achieve net zero CO2 emissions by 2050.

However, the report does not address some externalities that could significantly impact results, including nuclear waste disposal and airborne pollutants. The report also does not consider social costs and consequences for those who cannot afford distributed generation solutions. Despite these limitations, the report provides valuable insights into the current trends and future scenarios of energy investments and financing.

See more:

Introduction – World Energy Investment 2023 – Analysis - IEA